Singapore Insurance: What is ElderShield and CareShield Life

What is ElderShield?

According to CPF Board, Ministry of Health first launched ElderShield in September 2002. ElderShield was offered to eligible Singapore Citizens and Permanent Residents (PRs) who had a MediSave Account when they turned 40 years old in 2019 or earlier. We are automatically enrolled in ElderShield at the age of 40, unless we opted out of the scheme. ElderShield is a severe disability or total and permanently disabled insurance scheme. ElderShield is to provides basic financial protection to insured members who require long-term care especially in their old age. ElderShield provided payouts of $300/month for up to 5 years upon severe disability. It was subsequently reviewed in 2007 to provide better benefits of $400/month for up to 6 years (72 months).

ElderShield is currently administered by three private insurers appointed by the Ministry of Health. They are: Aviva Ltd, Great Eastern Life Assurance Co Ltd and NTUC Income Insurance Co-operative Ltd.

ElderShield to CareShield Life

According to Ministry of Health, from 2020, there will be no new auto-enrolments at age 40 into ElderShield. Singapore Citizens and Permanent Residents (PRs) who turn age 40 in 2020 will be enrolled into CareShield Life on 1st Oct 2020 or when you turn age 30, whichever is later. The Government will also be taking over the administration of ElderShield (no longer under administration by the three private insurers) from the insurers in end-2021. More information will be made available to ElderShield policyholders in end-2021.

What is CareShield Life?

According to Ministry of Health, CareShield Life is a long-term care insurance scheme that provides basic financial support should insured members become severely disabled, especially during old age, and need personal and medical care for a prolonged duration, example, long term care, due to stroke, spinal cord injurie, diabetes and dementia.

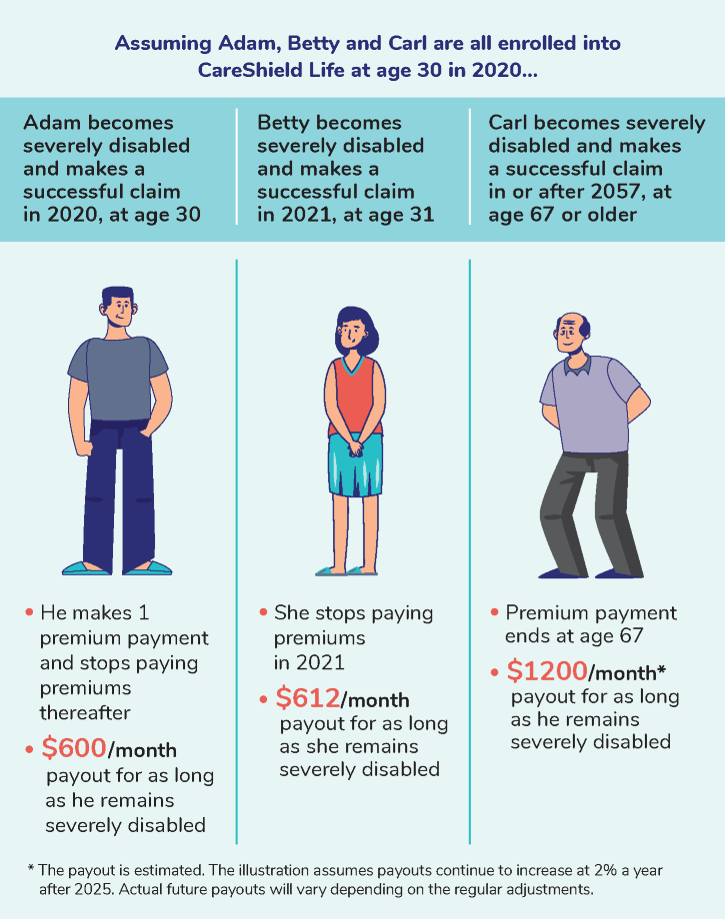

According to Ministry of Health, CareShield Life provide life long protection. Payouts start at $600/month in 2020 and increase over time. CareShield Life will continue to covered insured members for life once they have completed paying all their premiums, which will happen in the year they turn age 67 or 10 years after they had joined the scheme, whichever is later. Insured members will receive a monthly payouts in cash, for as long as they remain severely disabled. Payouts will be in cash so that insured members and their caregiver have the flexibility to decide on their desired care arrangements (for example, home care or nursing home care).

Example of payout illustration below: source from MOH

When are We Eligible to Claim on CareShield Life?

Insured members can make a claim if they are assessed by a Ministry of Health accredited severe disability assessor to be unable to perform at least three out of the six Activities of Daily Living (ADLs). The following are the 6 activities of daily living (ADLs):

- Washing

- Dressing

- Feeding

- Toileting

- Walking or Moving Around

- Transferring

One Last Thing

ElderShield to CareShield Life are long-term care insurance scheme that provides basic financial support should insured members become severely disabled, especially during old age. Having suitable and sufficient life and income protection insurance are also important as it create and provide you and/or family members, with financial support which was not there in the first place. Continue your insurance and financial planning knowledge by reading my other articles, for life insurance comparison on Term Life and Whole Life Insurance Comparison, and Income & Disability Protection Insurance Planning. If you are ready to know more about retirement planning knowledge you may visit my other articles on; What is CPF Life & 5 facts of CPF Life, Retirement Planning and Infographics on What is Retirement Planning and Examples. Hope all these articles helps you have better knowledge on you insurance and financial planning. Do contact your friendly financial consultant if you require further help, or contact me as my objective is to make insurance easy to understand and financial planning a happy process, in Singapore.

Source:

https://www.cpf.gov.sg/members/FAQ/schemes/Healthcare/ElderShield-CareShield-Life/FAQDetails?category=Healthcare&group=ElderShield/%20CareShield%20Life&folderid=18613&ajfaqid=2189867

https://www.careshieldlife.gov.sg/eldershield/about-eldershield.html

https://www.careshieldlife.gov.sg/careshield-life/about-careshield-life.html